Everyone loves to blame others when things go wrong. We also enjoy judging others. So, let’s play the game of judging and blaming and find the guilty behind the collapse of Silicon Valley Bank (SVB), the second largest bank failure in U.S. history, and the biggest since the 2008 financial crisis.

Banking Business Model

Business is all about risk. You just can’t make money in business without taking risks. However, banking business is different from other businesses in that debt is dominant over equity. Put simply, banks are highly leveraged institutions that are in the business of facilitating leverage for others. But high leverage inherent in bank business models also gives rise to problems and therefore needs to be prudently managed.

Silicon Valley Bank: What Went Wrong?

The bank failures usually occur on account of the ‘moral hazard’—indulging in excessive risk-taking due to strong expectation of government bail-out—but in the case of Silicon Valley Bank (SVB), a start-up focused bank, there were very few loans (the loan-to-deposit ratio was around 43%, the lowest among its banking peers) let alone risky loans and the accompanying credit risk. Yes, SVB was no Lehman Brothers. But it still collapsed. So, what went wrong? Paradoxically, it was on account of parking bulk of the deposits in US government securities, supposed to be the safest asset and investment grade bonds. A classic case of risk management gone wrong.

Technically, the bank failure was mainly due to asset-liability mismatch, which is an inherent part of banking business, but actually a series of unexpected events caught the SVB—a seemingly well-run bank—off guard. Right now, all accused are busy pointing fingers at each other.

List of Murder Accused

Here’s a long list of suspects accused of orchestrating the Silicon Valley Bank collapse:

- Vladimir Putin for driving global inflation through invasion of Ukraine.

- The US Fed for its supervisory and regulatory failure and also for hiking interest rates too far and too fast, after keeping them too low for way too long, in order to tame the inflation monster (in last one year the Federal funds rate is increased nine times from nearly zero to currently 4.75% to 5% range).

- The U.S. Government for not insuring all bank deposits (there’s a $250,000 deposit cap)

- The Moody rating Agency for not giving enough warning time to SVB—the rating downgrade threat came too late.

- The SVB senior management for trying to boost RoE by taking riskier bets in its investment portfolio (buying long dated bonds) and in the process taking undue duration risk and liquidity risk, for the deficient risk management framework that failed to flag and remedy the bank’s vulnerabilities early on, for keeping the post of Chief Risk Officer vacant for eight months, and for its PR and communication failure (failing to reassure nervous public investors and depositors that SVB would survive the crisis).

- The Investors for crashing the stock price on 9 March 2023 (more than 60% fall in only one day) on hearing that SVB was experiencing a cash burn and attempting a desperate capital raise.

- The Venture Capitalists including Peter Theil for advising their clients to pull their deposits out from Silicon Valley Bank

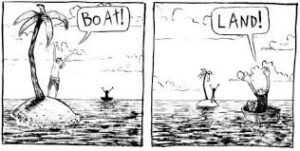

- The depositors (tech start-ups) for putting all their eggs in one basket and for getting panicky and sparking a run on the bank by withdrawing $42 billion—equal to a quarter of all deposits—in a single day.

- The social media for amplifying the bad news, creating mass hysteria and helping the rumors about SVB going belly up become true.

The Culprit

But who is ultimately responsible for dealing a death blow to Silicon Valley Bank? I think all of them are equally guilty for imploding the SVB. It also became a victim of its own success because the seeds of destruction were sown during its inception—unique business model of high reliance on institutional (fickle) deposits parked for short timeframes instead of retail (sticky) deposits— and also during exponential growth phase (flooded with deposits at a time of historically low interest rates—the SVB asset growth coincided with low yields) which became more of a curse than a blessing.

And if you ask me to choose the main culprit, my finger will point towards Putin for igniting the fire in the first place and forcing the Fed to tighten the money supply which led to the funding winter and eventually making Silicon Valley Bank its unintended victim.

Agree?

Also Read: